Freight audit and payment is the critical process of reviewing, verifying, and paying freight invoices to manage and control transportation costs. In 2025, as volatile rates and technological shifts increase shipping complexity, the global Freight Audit and Payment market is growing at a 13.8% CAGR, highlighting the urgent need for companies to gain control over their logistics spend.

Traditional audits that rely on manual processes are no longer sufficient. They increase the likelihood of costly billing errors, create bottlenecks that slow down your supply chain, and prevent it from achieving maximum efficiency. However, when done right, with the latest best practices and AI-powered software, the audit and payment process can cut unnecessary costs and improve efficiency in today’s demanding market.

This guide will explain the modern freight audit and payment process and show you the crucial steps to take to get up to speed in 2025. By the end, you’ll know how to efficiently check freight invoices and make accurate payments, which will help you avoid overpayments and streamline your financial management.

Key Takeaways from this Guide

- The freight audit and payment process involves multiple detailed steps, from initial invoice receipt and data capture to final payment and analysis.

- In 2025, auditing complex and often hidden accessorial fees is more critical for cost savings than verifying base rates alone.

- Modern AI, machine learning, and automation are essential for executing an accurate, efficient, and scalable freight audit and payment process.

- Outsourcing the FAP process to a specialized provider can lead to significant cost reductions, improved carrier relationships, and valuable logistical insights.

What Is a Freight Audit in the FAP Process?

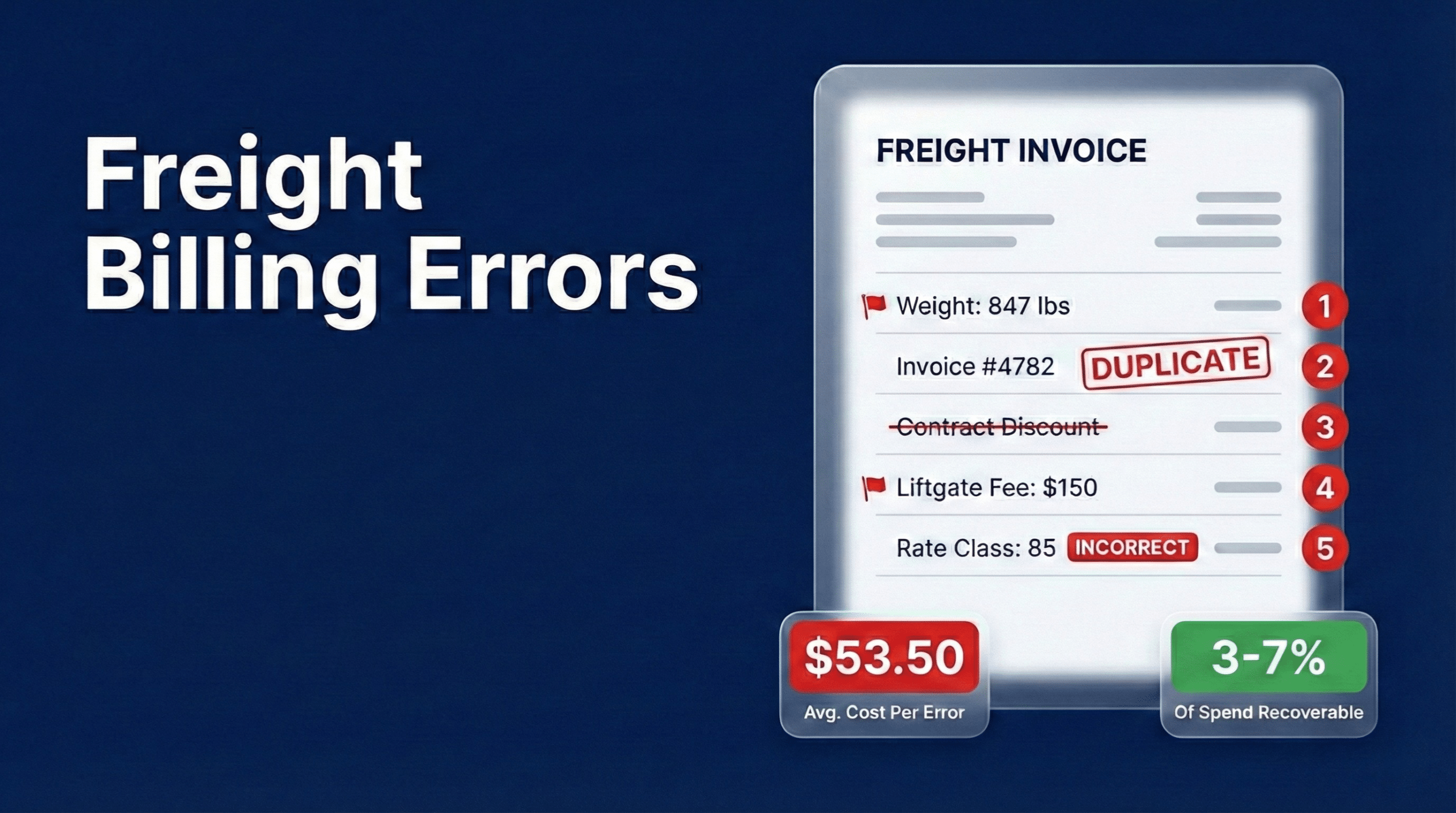

A freight audit is the meticulous process of examining freight bills to ensure their accuracy and achieve significant cost savings. Carrier invoices are increasingly complex, making it easy for billing errors to inflate shipping costs. An effective audit verifies that you only pay the contracted amount by identifying discrepancies that cut into your bottom line. This practice is vital for all businesses, especially those with high shipment volumes, where even small percentage savings can translate into millions in recovered freight costs.

What Does A Freight Audit Look For?

The primary purpose of the freight audit process is to identify billing errors and discrepancies that force you to overspend on shipping costs. By catching billing errors, you can work towards cost recovery through credits or refunds from your carriers.

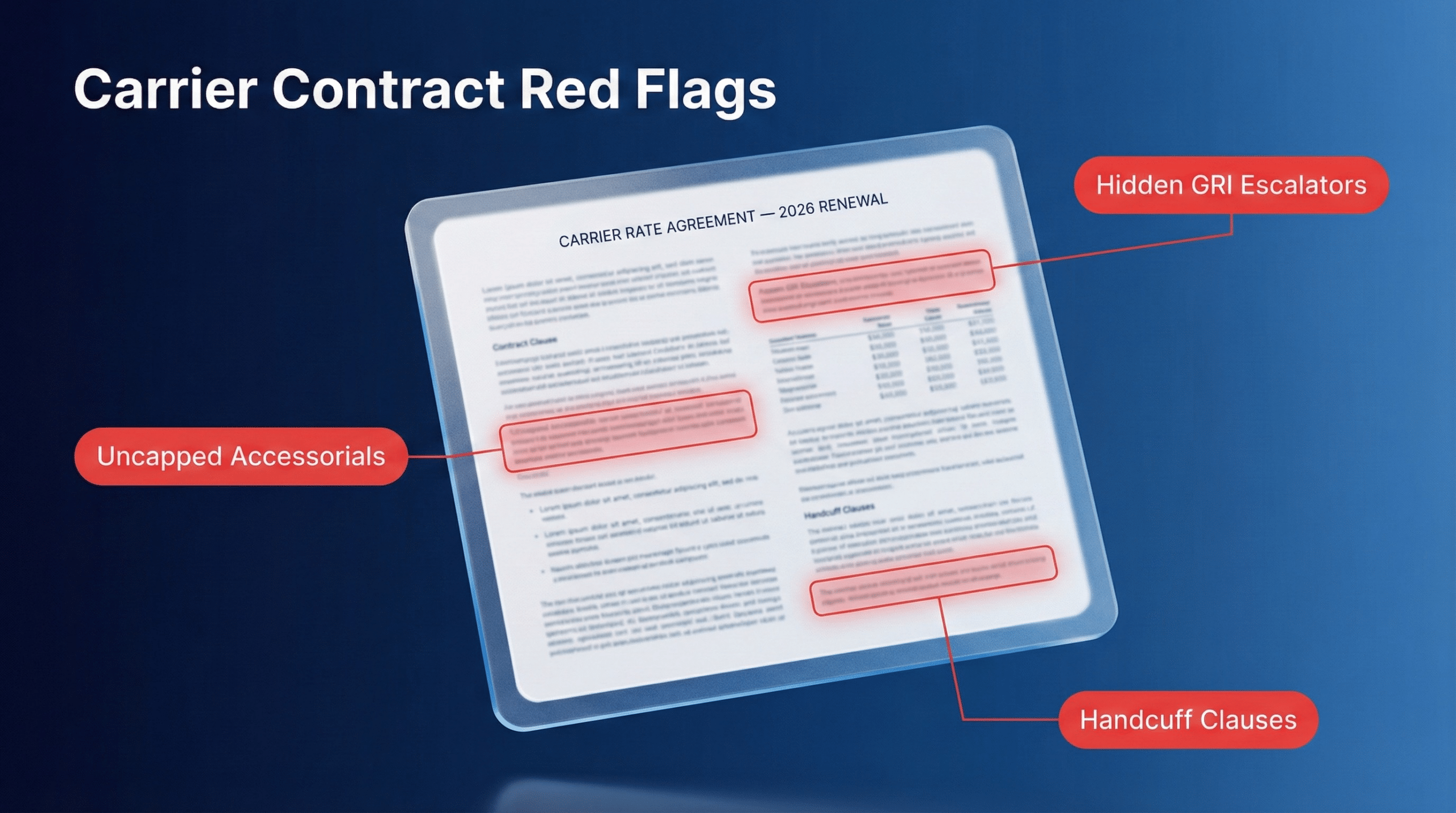

In 2025, a freight audit must go beyond simple rate checks and scrutinize a multi-layered fee structure. Here’s what a modern audit process looks for:

- Accurate Rates: While major parcel carriers like FedEx and UPS announced an average General Rate Increase (GRI) of 5.9% for 2025, this figure can be misleading. A proper audit validates not just the base rate but the complex web of surcharges against your carrier contracts and pricing agreements.

- Weight and Dimension Accuracy: Verifying correct shipment details to prevent overcharges for large or heavy shipments.

- Accessorial Charges: This is where the most significant overcharges occurred in 2025. A detailed audit verifies the necessity and accuracy of these accessorial fees across all modes.

- Duplicate Billing: Ensuring you haven’t already paid the freight bill, preventing costly duplicate payments.

- Service Level Provided: Checking that appropriate delivery timelines were followed and tracking was provided.

2025 Accessorial Charges: Key Audit Points by Mode

| Freight Mode | Common Accessorial Charges to Scrutinize | Key 2025 Audit Considerations |

| Parcel & Trucking | Delivery Area Surcharges, Large Package/Oversize Fees, Additional Handling, Detention, Reweigh Fees, Liftgate Fees. | Carriers have aggressively increased these fees (up to 28% in some cases). Audits must validate against the latest carrier tariff rules and ensure fees are not misapplied. |

| Ocean Freight | Terminal Handling Charges (THC), Documentation Fees, Port Congestion Surcharges, Demurrage & Detention. | These charges are not standardized across ports or carriers and can add $200-$500+ per container, impacting final landed costs. Audits must verify against specific port and carrier advisories. |

| Air Freight | Fuel Surcharges (CFS), Security Fees, Special Handling (e.g., temperature control, dangerous goods). | Fuel surcharges are now deregulated in major hubs, leading to high variability. Audits must confirm the correct CFS was applied based on the carrier and date of shipment. |

With freight audit services or an auditing tool, you can quickly check all of these details, and more, to increase your cost savings.

The Step-by-Step Freight Audit and Payment Process

The FAP process spans from receiving the invoice to clearing payment with the carrier. A breakdown of each step reveals the detail required for an effective system.

- Step 1: Invoice Receipt and Data Capture

A company receives invoices from its freight partners (freight carriers, third parties, etc.) from multiple sources. A modern system captures this invoice data electronically, helping to eliminate manual processes and reduce initial human error. - Step 2: Data Consolidation and Sorting

Invoice data is automatically grouped and sorted. This organization is crucial for batch processing and allows for a more systematic and efficient audit, especially when dealing with multiple systems. - Step 3: The Audit and Validation Phase

Each invoice is closely scrutinized for accurate billing. This core invoice validation step means checking for:- Accessorial charges: Are they valid and correctly applied?

- Duplicate charges: Has this invoice number or PRO number been processed before?

- Freight classification: Is the NMFC code correct for LTL shipments?

- Rate accuracy: Do the billed freight charges match the contract?

- Step 4: Exception Management and Dispute Resolution

When discrepancies are found, the invoice is flagged. Managing the dispute resolution process reduces the administrative burden and ensures credits are applied correctly. - Step 5: Approval and Payment Processing

Once audited, invoices are approved for the payment process. The company or payment providers then pay invoices using the agreed-upon method. - Step 6: Data Logging and Analysis

All transactions and costs incurred are logged. This creates a rich dataset for business intelligence, improving data visibility into your transportation network. This audit data is crucial for cost allocation, managing freight accruals, and analyzing your total transportation spend.

The Role of Technology in the Freight Audit and Payment Process

Technology has significantly impacted logistics operations. In 2025, the key technologies are AI, machine learning, and hyperautomation.

- Business intelligence, freight analytics platforms, and freight audit software go beyond basic automation to detect real-time errors.

- Automation combines artificial intelligence and RPA to create end-to-end workflows.

- Blockchain technology can enhance security for the entire payment system.

Real-Time Data Processing

The market moves fast, and real-time data enhances precision in examining and verifying freight bills.

Integrating Systems for Seamless Operations

Integrating freight audit systems with a transportation management system (TMS) is vital for cost control and efficiency.

Key Benefits of an Optimized FAP Process

With up to 18% of freight invoices containing hidden or uncontracted charges, an optimized audit and payment process is crucial for protecting your bottom line. Whether handled in-house with modern software or through a third-party provider, an effective FAP solution offers several key benefits:

- Significant Cost Savings: By systematically identifying and correcting billing errors, duplicate charges, and incorrect fees, you ensure you never overpay for shipping.

- Increased Operational Efficiency: Automating the audit and payment workflow frees up your team from tedious manual tasks, allowing them to focus on higher-value strategic activities.

- Improved Carrier Relationships: Streamlining payments and establishing a clear process for resolving disputes fosters trust and strengthens partnerships with your freight carriers.

- Actionable Logistical Insights: Centralized data from the FAP process provides valuable insights into carrier performance and shipping patterns, empowering you to make data-driven decisions and negotiate better contracts.

Choosing the Right Provider

The right freight audit provider should offer comprehensive payment services and use modern technology to enhance your bottom line and drive growth.

Streamline Your Supply Chain with The Right Freight Audit and Payment Solution

Freight audit and payment services play a critical role in streamlining workflows and saving money. Don’t get left behind—choose the right provider to future-proof your operations.

FAQ

What is the first step in the freight audit and payment process?

The first step is always invoice receipt and data capture. A modern process automates this to minimize manual entry and reduce the chance of human error from the very beginning.

How long does the freight audit and payment process typically take?

A manual process can take weeks. An automated FAP process can reduce the cycle time to days or even hours, ensuring timely payments.

What are the most common errors found during the freight audit process?

In 2025, the most common errors are incorrect accessorial charges. Duplicate billing is also a frequent and costly error caught by automated systems.

Can small businesses benefit from a formal freight audit and payment process?

Absolutely. A formal FAP process, even through a scalable third-party provider, can deliver significant ROI by identifying significant savings opportunities and recovering erroneous charges.